Annuity with inflation formula

3841 yarbrough ave winston-salem nc 27106. An inflation rate of 4 means.

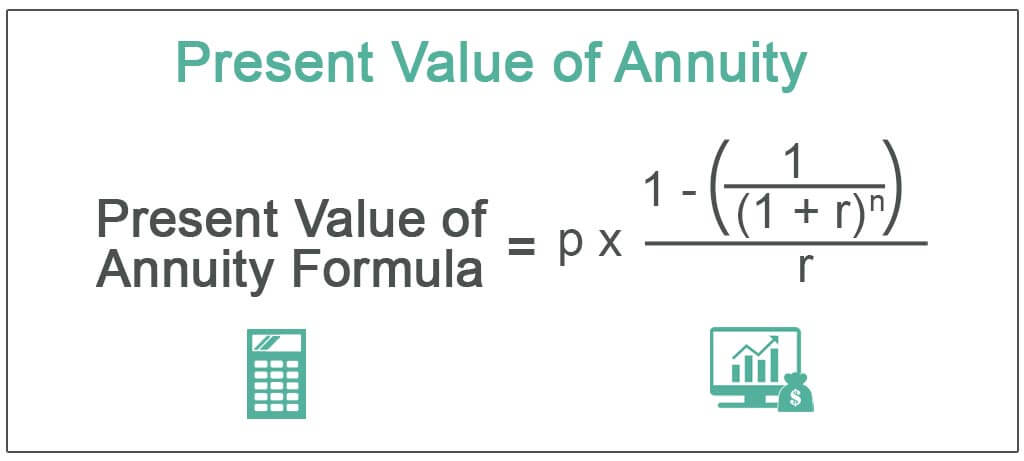

Present Value Of An Annuity Definition Interpretation

According to the US.

. Dating technique using natural decay rate of. Securities and Exchange Commission the real rate is the true economic benefit offered by an investment after taking into account taxes and inflation. By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1.

Capital cities in alphabetical order. If x is our initial payout then its present value is obviously. The calculation of an annuity follows a formula.

If your annuity pays a fixed 3000 per month for life and inflation increases 10 the buying power of your. Annuity with inflation formula. Calculate the present value of the annuity if the discount rate is 4 while the payment is received at the beginning of each year.

These annuities tend to provide a lower payout to investors than other types of annuities on the market. For example if the average annual inflation rate is 3 percent over the next 20 years it will cost. Even a low rate of inflation can significantly erode purchasing power in the long run.

Let I104 be the inflation rate and Y110 be the investment yield. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. An annuity with inflation protection refers to the guaranteed stream of income that increases over time to keep up with inflation.

Annuity with inflation formula. An annuity investment that. Fixed Index Annuity A fixed index annuity allows you to earn a higher rate of return than a traditional fixed annuity without the risk of losing your principal investment.

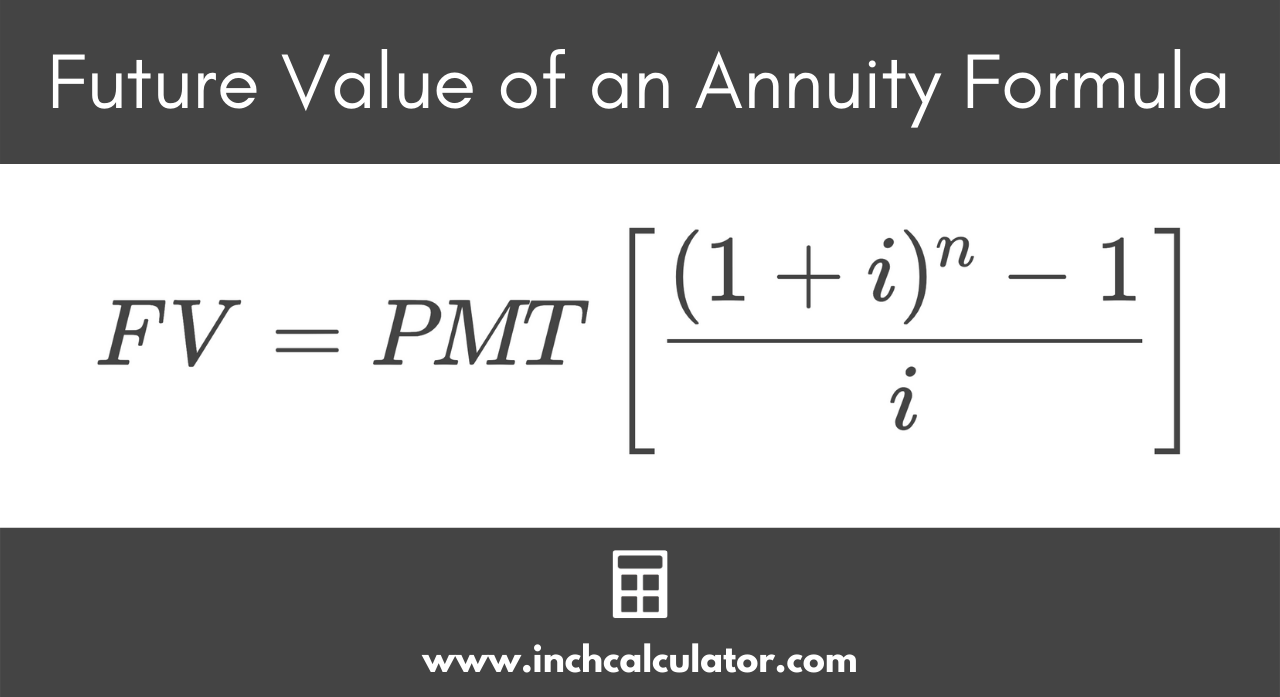

In words at the start of next year the investment is P 1I and the return less the increased payout of p 1I leaves an investment of P 1I2 for the following year. Future Value of an Annuity C 1in - 1i where C is the regular payment i is the annual interest rate or discount rate in. An inflation-protected annuity IPA is a type of annuity product.

Theres actually a much simpler way to derive this formula. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. The primary risk of most annuity payouts therefore is inflation.

Present Value of Annuity Due is calculated using the. Payments are indexed to the rate of.

How To Calculate Present Value Of An Annuity

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of A Growing Annuity Formula With Calculator

Ordinary Annuity Calculator Future Value Nerd Counter

11 3 Present Value Of Annuities Mathematics Libretexts

Future Value Of An Annuity Formula Example And Excel Template

Present Value Of An Annuity How To Calculate Examples

Future Value Of An Annuity Calculator Inch Calculator

Present Value Of An Annuity How To Calculate Examples

Present Value Of Annuity Due Formula Calculator With Excel Template

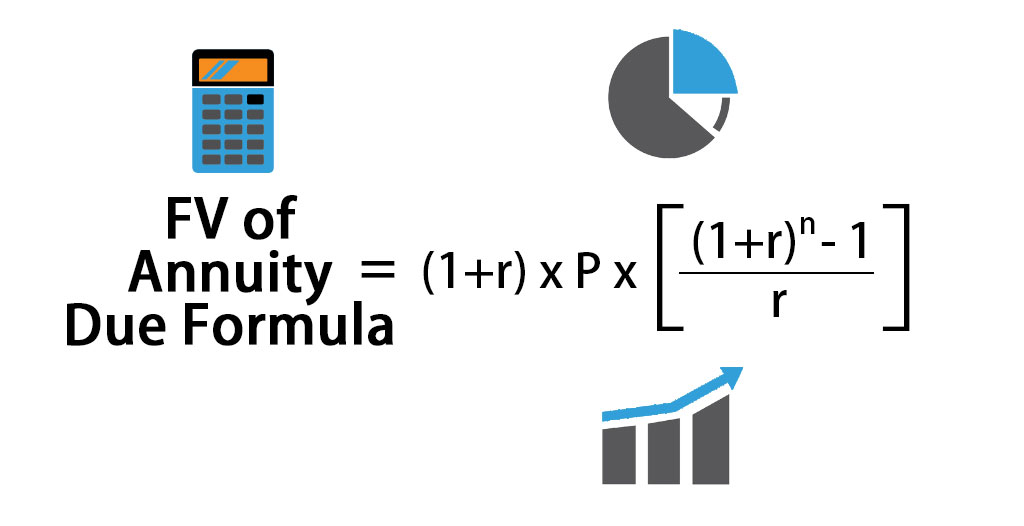

Annuity Due Formula Example With Excel Template

Annuity Formula Annuity Formula Annuity Economics Lessons

Annuity Present Value Pv Formula And Calculator Excel Template

Future Value Of Annuity Due Formula Calculator Excel Template

Growing Annuity Formula With Calculator Nerd Counter

What Is An Annuity Table And How Do You Use One

How To Calculate Present Value Of An Annuity